What Time Is Trash Collected Family Dollar Diving Dumpster

IN A CITY known for its diversity and random urban aesthetics, trash dumpsters, used by thousands of Los Angeles businesses and institutions every mean solar day, are not exactly noteworthy sights. The notion that we should starting time paying more than attending to these coordinates of MSW — that's "municipal solid waste," or everyday, ordinary trash — might seem a tad bit odd. Merely look a lilliputian closer at the various dumpsters dotting this city and you'll observe a bewildering number of company names, colors, and logos. In fact, these containers represent a dizzying array of waste disposal companies taking role in a kind of free market, privatized trash exchange, with LA's waste the hot commodity.

This is the mode it's been for decades — a wonderful if not puzzling demonstration of the free market concept gone wild. In Los Angeles, whatever firm is able to service a business's waste matter disposal needs in any function of the city for any rate they cull to set — a combination of tolerable anarchy, basic functionality, and unfettered contest.

But things are set to change. Enter the Bureau of Sanitation (LA Sanitation), part of the Urban center's Department of Public Works. It is rolling out a framework for franchising Los Angeles' privately operated waste disposal and recycling firms. This is a one thousand experiment on a monumental scale designed to bring order, uniformity, organization, efficiency and equity to an essential service for the commercial sector: solid waste material direction.

What is behind LA Sanitation's determination to enter an arena where information technology has previously been largely uninvolved, to make such a bold move that will transform its role from marginal player to central coordinator?

In a discussion, or actually a phrase, AB 939.

In the Starting time

In 1989, the state legislature adopted Assembly Neb (AB) 939 — titled more formally the Integrated Waste product Management Human action. It's no exaggeration to say that in the subsequent 25 years there has been an ongoing revolution in waste matter direction practices throughout California. AB 939 fundamentally altered the regulatory, political, and economical framework inside which those practices occur to deemphasize landfill disposal and push waste matter reduction/prevention, reuse, recycling, composting, mulching, and other methods more often than not referred to equally "diversion," meaning alternatives to burial trash.

Amidst other provisions, AB 939 created the California Integrated Waste Management Lath (CIWMB); established initial diversion rate requirements for all jurisdictions (counties and cities) of 25 percentage by 1995 and 50 percent past 2000; required jurisdictions to fix plans for achieving such diversion; designated public agencies and entities as primarily responsible for reaching the 25 and l percent diversion standards; and empowered counties and cities with broad powers to enhance funds and appoint with the private sector to come across those standards.

AB 939 has been modified and extended over the years. The CIWMB was reinstituted as The Department of Resource Recycling and Recovery of the Land of California. You tin can shorten this to "CalRecycle."

A significant revision and expansion of AB 939 came in the form of AB 341, which the legislature passed in 2011. AB 341 directed CalRecycle to develop and adopt regulations for mandatory commercial recycling, with compliance commencement July one, 2012. More than specifically, businesses with four cubic yards of trash or more than per week (that's the size of a medium dumpster) and multifamily buildings with five units or more than must secure recycling service. This would be done with the assist of local jurisdictions and the private waste material hauling/recycling industry.

AB 341 also said the agency has to submit a report to the Legislature with a plan for reaching 75 pct diversion statewide by 2020. You read that correct — 75 percent diversion. The formula for determining the diversion rate is equally follows:

► Generation (tons) = Disposal (tons) + Diversion (tons)

therefore,

► Diversion Rate = Diversion

Generation

LA Takes Giant Step

If the state as a whole is to make 75 percent diversion then the big cities need to be on board. That's why LA Sanitation has rolled out a dramatic initiative to implement exclusive franchises for commercial sector disposal and recycling services throughout the Urban center.

The person leading the endeavour is Karen Coca, Recycling Division Director and a 22-year veteran with the City'southward solid waste product disposal and recycling program.

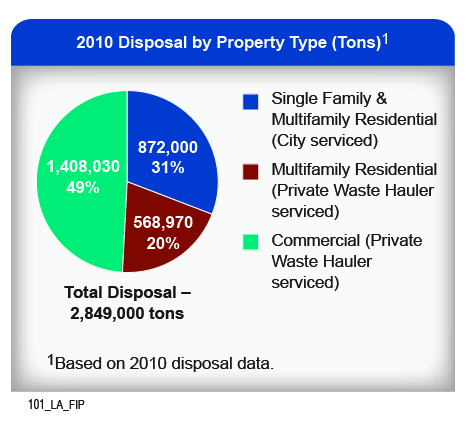

Up to this point the City's role in waste material management has been limited to the residential sector. Garbage crews wearing City of LA uniforms provide collection of refuse, recyclables, and green waste to single-family homes and multifamily buildings with 4 units or less for a total of near 750,000 customers (530,000 single — family unit homes and 220,000 buildings upwardly to iv units). This in a city of nearly four million people with 224 identified languages, spread out over more than than 468 square miles covering every conceivable form of urban geography — a veritable United Nations of indigenous, cultural, demographic, and socioeconomic groups. What has been express is the Metropolis's involvement with disposal and recycling services in the commercial sector. Currently private haulers must obtain permits from the Metropolis to operate, but aside from that, the free market prevails.

LA Sanitation wants to change all this. The agency has ended the laissez-faire approach is not consequent with the Urban center achieving some very ambitious diversion priorities, namely the "Naught Waste Goal" from the RENEW LA Plan (Recovering Energy, Natural Resources, and Economic Benefits from Waste for Los Angeles), unanimously adopted past the Metropolis Council in 2006. That goal is to reach a xc percent diversion level by 2025, thus reducing landfill disposal to the absolute minimum.

The "F" Word

LA Sanitation'south definition of zero waste product is a broad i that includes waste reduction/prevention, reuse, recycling, composting and mulching. But information technology also covers all manner of alternative conversion or transformation technologies that turn remaining waste product or "residual materials" into free energy, fuel, and other benign uses. In that location are two general categories of these technologies: thermal (examples: waste-to-free energy incineration, plasma gasification, pyrolysis) and biological/chemic (examples: anaerobic digestion, syngas to ethanol/methanol, thermal depolymerization). Basically whatever avoids landfill disposal fits nether the zero waste banner.

To boost diversion, LA Sanitation determined that a much more systematic, structured strategy was needed for the commercial sector to replace the loose arrangements between generators and haulers under the free market place status quo. And that meant a significant policy departure from the past, one that would allow LA Sanitation to create exclusive territories, set service standards, and enter into contracts. In a give-and-take, franchising.

LA Sanitation spelled out its franchising initiative in a detailed 62-page report titled "Terminal Implementation Plan for Exclusive Commercial and Multifamily Franchise Hauling System" issued in April 2013 ("Plan"). The main features and purposes of the Plan include the post-obit:

- The franchise system is aimed at municipal solid waste, not medical, hazardous, radioactive, and pharmaceutical waste or structure/demolition (C&D) debris.

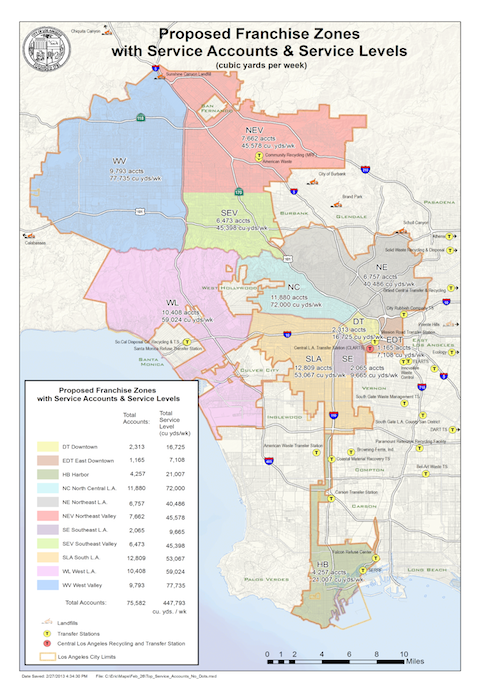

- Xi exclusive franchise zones have been defined, and they will probable range between a depression of i,000 accounts to equally loftier as xiii,000 accounts.

Notation: LA Sanitation distinguishes betwixt a commercial "generator" and an "account." As explained by Karen Coca, "In some cases, perhaps many, a generator and an account are the same, like a unmarried retail store. But say for shopping malls or multifamily buildings, the complex as a whole is considered an business relationship even though there are many generators within it." There are an estimated 75,582 accounts in the xi franchise zones, according to LA Sanitation. However, based on an analysis prepared for the bureau,"the City has more than than 150,000 waste matter generating commercial and industrial businesses, governmental and educational entities" across all the zones ("Zero Waste Progress Report," March, 2013, prepared by faculty and students at UCLA Engineering Extension'southward Recycling and Municipal Solid Waste matter Direction Program).

Graphic courtesy of the City of Los Angeles Bureau of Sanitation/

Graphic courtesy of the City of Los Angeles Bureau of Sanitation/

Section of Public Works

- The term of the franchise agreements will be 10 years with two five-year renewal options. The benefit of long-term contracts is that they brand information technology easier for the private sector to secure financing for anticipated capital letter expenditures (like trucks, containers, handling equipment), offer an extended period of time for spreading out costs and therefore controlling rates, and give assurance to lending institutions that debt will be serviced on schedule.

- Franchising is intended to facilitate the recovery of recyclables and organics (food and dark-green waste product) for processing and reuse.

- Belatedly model, low emission, clean fuel trucks will exist required, thus contributing to improved air quality.

- Franchising will promote consolidation and efficiency in road structures and this volition take a positive impact on vehicle/traffic congestion.

- Health and safe conditions for employees of private solid waste/recycling firms will be improved, and LA Sanitation volition certify and inspect relevant facilities of the prime franchisees and their subcontractors.

- Franchisees volition be required to carry promotion/didactics/outreach activities in coordination with LA Sanitation staff.

- LA Sanitation will monitor client complaints, feedback, and track franchisees' responsiveness to such concerns.

- The City will be involved with rate-setting and with defining cost-of-living increases that impact rates.

- The provisions of the Metropolis's employment diversity program will be practical to the franchise contracts. Additionally, the City'southward Living Wage Ordinance will be in upshot.

- The franchises are for solid waste collection and management. Franchisees will be required to provide a baseline "suite" of recycling services but generators/accounts can use those services or set alternate arrangements with another private recycling service provider if the recycler is not paid for their services. By previous legal precedents, recyclables from commercial sources that are given abroad or sold cannot be subject to an sectional franchise.

- For each franchise zone maximum disposal amounts will exist defined that the service provider cannot exceed and correspondingly diversion rates will be set that must be accomplished.

- To aid LA Sanitation build an accurate database for monitoring and evaluating implementation progress, franchises will have reporting requirements. Potential data to exist covered include quantities of material disposed and recycled; number and types of accounts and service levels (container number and size, collection frequency); technical assist contacts to customers on waste reduction/recycling program development; resolution of customer complaints and service problems; and facilities/subcontractors used for disposal, recycling, and organics.

Other Critical Elements

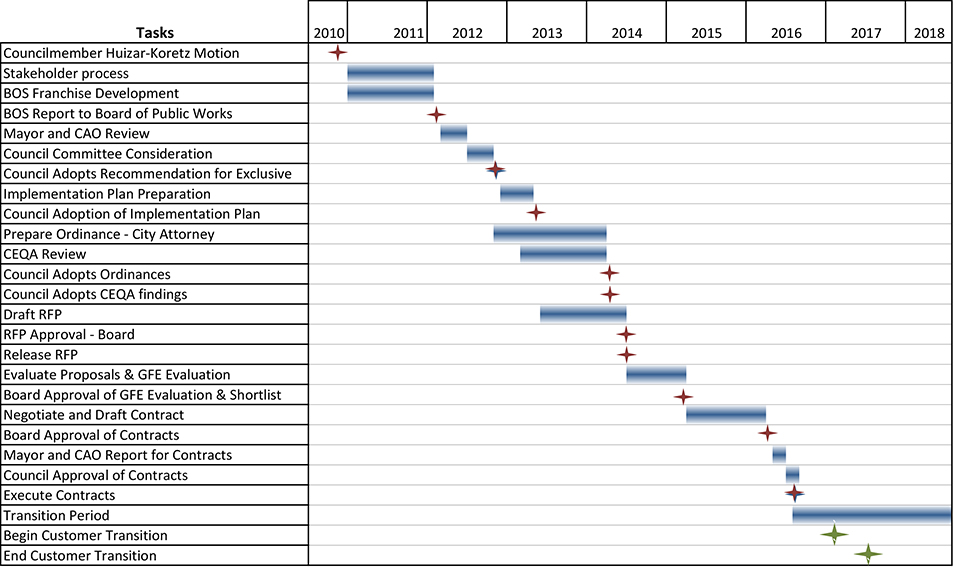

Karen Coca, 3 other LA Sanitation staff members, and a consultant team headed by CH2M Colina are preparing a master Request for Proposals (RFP) with sections for each franchise zone to secure qualified service providers. Coca says the project is on schedule, with a necessary Environmental Bear on Report and Ordinance submitted to Urban center Council in March and the RFP to be released in June. Responses to the RFP volition likely display intense competition due to the size and elapsing of the franchise agreements. The proposals are expected to showcase state-of-the-art approaches to diversion programs, customer services, and oversight that are tailored to Los Angeles' unique circumstances.

The overall implementation sequence of 26 steps, portrayed in an accompanying chart, began in 2010 and goes through 2018. The RFP writing/approval/distribution occurs around the midpoint of that timeframe.

Graphic courtesy of the City of Los Angeles Bureau of Sanitation/

Graphic courtesy of the City of Los Angeles Bureau of Sanitation/

Section of Public Works (click to enlarge)

Equally part of the proposed exclusive franchise system, the City intends to accuse a franchise fee. "The franchise fees are to be negotiated with the haulers through the contract process, with a floor of 10 percent of gross receipts," Coca stated, calculation "we currently approximate that at this level approximately $21 meg per year would flow to the Metropolis."

In examining how to reach their nix waste matter priorities, LA Sanitation evidently concluded a much more proactive role for the City was needed in the commercial sector. In essence the franchising Program substantially extends the ability and authority of the City to implement public policy through privately-operated programs the City finer manages and administers. In this sense the franchises become mechanisms for implementing multifaceted ecology policies with benign impacts on air quality, traffic congestion, resource conservation, waste material diversion, and alternative fuel utilise.

The results of the franchise system are intended to be exactly the reverse of existing circumstances in the commercial sector—what LA Sanitation desires is standardization, uniformity, consistency, efficiency, and equity. Nevertheless, the franchising Program contains this notation of caution: "A franchise system for the City, due to its size, geography, and demographics, will be the largest and most challenging to develop in the nation."

Small Haulers

"The companies and assets of the small haulers now have no value," said one manufacture veteran who has lived and worked in the Los Angeles region for decades. His point was, why would anybody purchase access to accounts that are going to go function of a franchise?

Good question, and for the haulers involved probably one with not a very encouraging respond.

LA Sanitation spends a lot of ink in the franchising Plan talking about how to keep small haulers competitive in the franchising process. The phrase "pocket-size hauler" is, at this juncture, imprecise at all-time, as Karen Coca acknowledges:

At that place is actually no clear definition of a small hauler right at present. In full general, we use the term to distinguish those that are primarily local, family unit-endemic businesses from those that are larger regional, national, or even multinational companies.

The economics of garbage and recycling are based on book and aggregation. Thus it is reasonably articulate that big, established firms with extensive resource in the form of personnel, expertise, finances, experience, equipment, and multiple services are in a favorable position to meet the wide-ranging performance standards discussed in the LA Sanitation franchising Plan. Industry consolidation seems inevitable. The dilemma is how to remainder those driving realities confronting the equitable distribution of business opportunities — the franchises — to smaller waste material service firms.

LA Sanitation'south franchising Plan acknowledges these problems and proposes a solution:

[…] many small to medium sized haulers currently service less than i,000 accounts and may not have the resource to provide service to large service areas. When surveyed, these haulers indicated that small zones should be sized in the two,000 business relationship range. Sanitation designated three smaller zones that will provide opportunities for small to medium sized haulers. These franchise zones are S-East with ii,100 service locations, Downtown with 2,300 locations and East Downtown with 1,100 service locations […] To protect the intention of the smaller zones […] these zones are to be awarded to 3 separate waste haulers and cannot be combined with other zones.

Still, at the Los Angeles Canton Disposal Clan the mood is subdued just businesslike. "Clearly the commercial franchising initiative is a major priority of the City," says Ron Saldana, head of the Association, which counts amid its members precisely those haulers targeted by LA Sanitation'south three-zone set-aside scheme. "We don't have a problem working closely with municipalities," he explained, "we do that all the time. We're just non real in favor of them being involved with rate-setting through franchises."

Saldana further commented that some Clan members are wondering whether the standardization and uniformity of rates and services that LA Sanitation is seeking through exclusive franchises is possible, even desirable, given the multidimensional diversity plant in LA. "Despite our concerns we will piece of work with the City to clinch a smooth transition to the franchising system," Saldana noted. Indeed, the membership is looking into the idea of merging individual companies together into one or more than single entities for purposes of responding to the RFP for several zones.

Nonetheless, the Clan is not deluding itself. "Information technology's obvious some won't arrive," Saldana says with regret, "but our attitude is how exercise nosotros have some command over the situation and cutting our losses. The train has left the station and our basic strategy at this betoken is non to get run over."

Coca'southward Commentary

The Los Angeles Review of Books solicited responses from LA Sanitation's Karen Coca on two pivotal questions:

- What was the rationale for rejecting the non-sectional franchise approach (Los Angeles County'southward Public Works Section followed this arroyo) and going with exclusive ones? (NOTE: With not-exclusive franchises, singled-out operating territories or zones are prepare up just within them there is open competition, in other words there tin be multiple service providers vying for customers.)

- Given that the franchising Plan states the Urban center has already accomplished 72 percent diversion, which is quite high, with the existing mixture of public/private services, why is such a meaning departure to a organisation of exclusive commercial franchises needed?

Coca provided a written answer to these questions, equally follows:

In our electric current let system, the tiptop 10 haulers collect 98 percent of all the materials from multifamily buildings and commercial businesses, and a number of small haulers take minimal recurring commercial drove, just all may work in any surface area of the Urban center of Los Angeles. And as you can tell by the pie chart nosotros provided, at that place are nearly two million tons of tending reject annually from these sources being handled by private haulers. Inefficient routes overlap each other, and businesses tin can modify haulers, and service at will. Prices for service are negotiated and vary widely from business to business. Recycling is a separate charge, and then many businesses do not want to pay for recycling services. This results in a large corporeality of recyclable material reaching landfill disposal each yr. The exclusive franchise organization requires that all customers have recycling services, tailored to the needs of each business organisation.

Graphic courtesy of the City of Los Angeles Agency of Sanitation/

Graphic courtesy of the City of Los Angeles Agency of Sanitation/

Section of Public Works

Efficient routing can reduce non simply the number of trucks in each commercial corridor and overall, simply also smart routing can reduce emissions and accidents every bit well. Clean fuel trucks volition be required, as they are currently in many other communities.

Customer service for bug as well varies widely, even for customers that apply the same solid waste hauler. The exclusive franchise arrangement is being tailored to bring the entire industry up to standards that include communication on all platforms, firsthand customer feedback, and timed client response. Liquidated damages for non-compliance and poor customer service will bring accountability to the solid waste matter arrangement, which currently is not nowadays. These are a few of the reasons the Metropolis is moving to an exclusive franchise system.

Actually the latest information shows that the City of Los Angeles is at 76 percentage diversion overall, using the calculation methods employed in the Country of California. Although many customers in the Metropolis have reduced their waste dramatically since the 1990's, the City still disposes of iii one thousand thousand tons of solid waste product per year from all sectors. An unregulated market place, in which customers and haulers have no incentive to recycle more materials, will not upshot in the additional diversion needed to achieve our goal of 90 per centum by 2025. To go to our Zero Waste goals, expanded and new programs must be implemented. The sectional franchise system volition provide secure contracts that solid waste haulers can use to invest in the infrastructure needed to reach Nil Waste material.

As well, because the City of Los Angeles is incredibly large and diverse, standardizing the customer experience volition reduce confusion almost recycling and create a much more understandable, and simpler, system. For example, extending the same commingled or single stream recycling method that exists for all single-family customers, nearly multifamily buildings, Urban center facilities, and the LA Unified School Commune to all businesses will create a better customer experience and reduce confusion almost recycling past allowing the Metropolis to create one set up of outreach and education materials. Level, equitable rates will also assist customers in planning for long-term expenses, rather than requiring them to bid and negotiate ofttimes for services.

Finally, accountability in the system will be improved by performance standards in viii to 11 exclusive franchise agreements that include liquidated damages for non-performance. The exclusive franchise agreements will crave boosted diversion on a ready schedule for the term of the contracts. These requirements cannot be fabricated in a non-sectional system where a permitted hauler's customer base of operations is a moving target.

Digging Into the Information

- In 2011, refuse from the City of Los Angeles establish its mode to no less than 26 landfill sites in California with locations ranging from the Mexican border to the San Francisco Bay Area.

- The overall diversion rate for the Urban center has risen steadily from 21 percent in 1990 to the most recent effigy of 76 percent.

- The Urban center'due south population has climbed over the last decade to merely shy of 4 million.

- At that place has been a dramatic reduction in tending tons starting in 2007 and going forward. Betwixt 2007 and 2011 disposal from City sources savage from three.6 one thousand thousand tons per yr to 2.9 1000000.

- Correspondingly for the same menstruum in that location has been a decrease in the per capita disposal charge per unit from 5.3 pounds per person per day to iv.2.

- LA Sanitation's cadre diversion programme provides curbside recovery of commingled or mixed recyclables and yard waste from the residences it services with waste collection. From 2000 to 2011, the total quantity of recyclables and grand waste product varied from a low of 452,000 tons per year to a high of 521,000 tons. In other words, a difference of effectually 70,000 tons. This is not a huge level of variation — information technology could even exist partially explained past seasonal changes in the generation of thou waste. The tonnage amounts indicate that the client base participating in the programme is relatively stable.

These are some of the intriguing statistics and data offered in the previously cited Cypher Waste Progress Report which, incidentally, has 500 pages of appendices to plow through if you are so inclined. But let's step back and await at the context for these numbers to see what they may reveal.

We have three principal, parallel patterns: a refuse in disposal, a rising diversion charge per unit, and largely consistent material quantities recovered from the residential sector past LA Sanitation crews. A huge contextual factor is the Nifty Recession, whose timeframe correlates with the falling amounts of tending garbage. Indeed, one consultant, who has been closely involved with efforts to mensurate the impacts of AB 939 since its inception, remarked to me that some of the LA region landfills he deals with take reported annual disposal volume reductions of twenty to 25 per centum over the form of the recession. This is a nation-broad pattern on which merchandise publications in the solid waste field have reported.

And it makes sense — that is, common sense. With persistently loftier unemployment, marginal wage increases, rise living costs, tight cash flow, and record levels of corporate profits sitting on the sidelines not being invested, people are but going to spend less and consequently generate less waste.

Now about that increasing diversion rate. Here is where some mathematical trickery could come into play and be partly influential. Recall the definition and formula for computing the diversion charge per unit presented before:

► Generation (tons) = Disposal (tons) + Diversion (tons)

therefore,

► Diversion Rate = Diversion

Generation

So, if disposal is downwards then the diversion rate will go upwardly even if in that location is no actual increase in diverted tons. Adding to the mystery, the diversion rate has gone upward markedly even with an essentially stable contribution from the residential sector serviced by LA Sanitation. What so, is behind the ascension diversion rate?

Three factors actually. First, a vast network of private companies throughout Southern California that collect, receive, purchase, sort, upgrade, set, and process recyclable materials from commercial/institutional sources for shipment to manufacturing and re-manufacturing markets. Some of these companies are trash haulers motivated to recycle by the AB 939 diversion requirements that cities and counties have written into their service contracts. They operate MRFs — material recovery facilities — to perform the intermediate processing functions of recycling after collection and prior to marketing.

The 2d cistron is the Port of Los Angeles/Long Beach and the admission it provides to export markets. And the magnet that pulls those container vessels full of American recyclables beyond the Pacific Ocean? That would be Cathay. This is the tertiary factor. "China is everything" Adam Minter has emphasized (VICE Podcast Interview, December 2, 2013, with Wilbert Cooper). He ought to know. Minter has been reporting from Shanghai for several years on the curious, mutually dependent economic relationship between the US and Red china as reflected in the flow of scrap metals, newspaper, and plastics.

We send those materials to China and they are used to modernize, urbanize, industrialize the country. They are the fuel for Communist china's growth. They also come up dorsum to us in the class of consumer products nosotros buy. Minter's contempo book — Junkyard Planet: Travels in the Billion Dollar Trash Trade — is an entertaining, fascinating description of how what is widely perceived in the US as a conservation practice — recycling — has been critical to the expansion of China's economy. And this is an economic system largely energized by coal-fired ability plants that are prime sources of greenhouse gases and global warming. So you lot recall politics makes for strange bedfellows?

LA'due south Garbage Empire

The commercial sector franchises being pursued by LA Sanitation volition result in a major expansion of the City's power and authority over solid waste direction in Los Angeles. The City is already the sole service provider for the residential sector. The franchises will essentially create a solid waste management system for the commercial sector. This will put LA Sanitation in the position of administering the collection, handling, and processing services provided by private companies for the disposal and recycling of materials from commercial generators.

The franchising initiative fundamentally redefines the boundary lines between the public and private sectors regarding solid waste management for the second largest urban center in America.

¤

Richard Hertzberg is an ecology consultant and photojournalist based in Lake Oswego, Oregon.

Source: https://lareviewofbooks.org/article/city-la-goes-dumpster-diving/

0 Response to "What Time Is Trash Collected Family Dollar Diving Dumpster"

Post a Comment